The media and Tesla shorts and haters love to tout every new BEV that comes to market as the latest “Tesla Killer.” That moniker usually has little basis in reality, but is simply used to attract media eyeballs and haters and shorts use it to rally the bearish story on Tesla.

Headline writers will often compare any new electric vehicle to those from Tesla and use the “killer” world to drive increased readership and eyeballs. And because these headline writers actually are not experts on the trends in electric vehicles, “Tesla Killer” is the easy route to take.

But actually reading many of these articles you discover that the tone is often much more balanced, and the new EV in question isn’t actually pegged to “kill” Tesla. Rather it is typically suggested that these new EVs could be strong competition for Tesla and hurt sales. In other words there is usually a disconnect from what a reporter actually wrote and what the headline writer decided to run with.

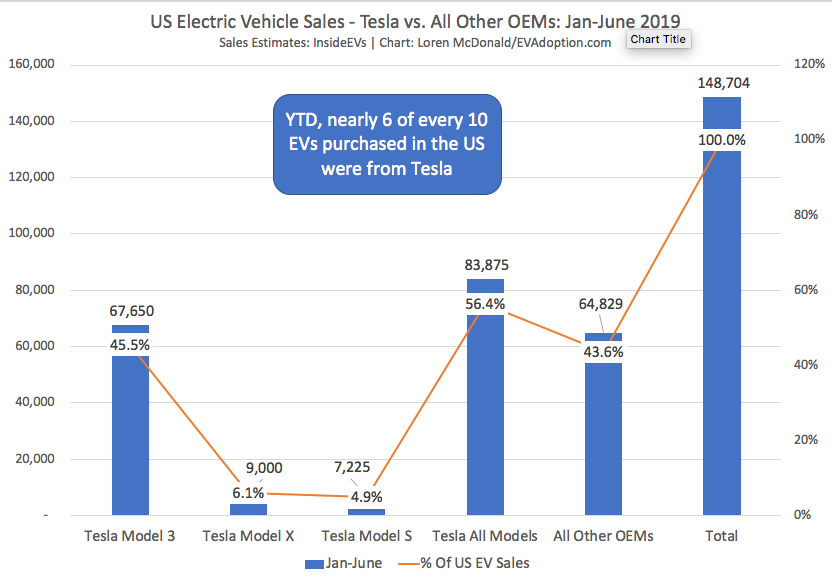

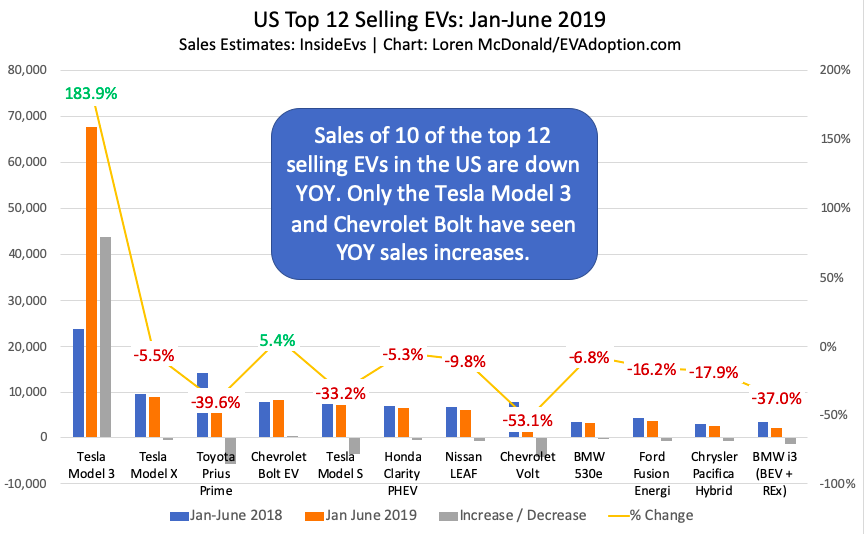

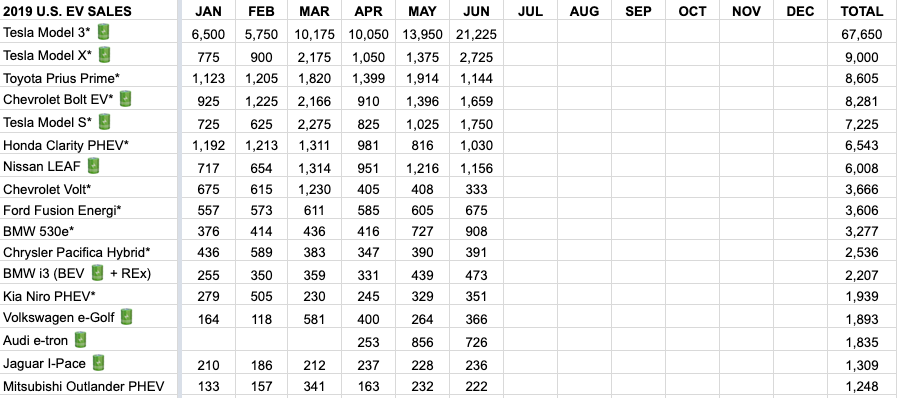

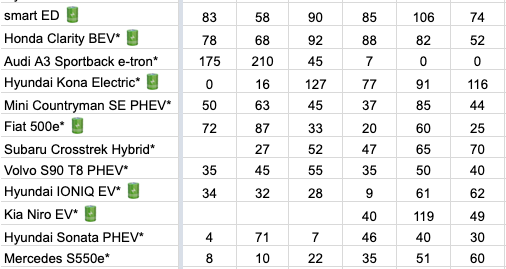

To date, and at least in the US, there is little evidence that any of the “Tesla Killer” EVs are actually having a significant impact on sales of Tesla models.

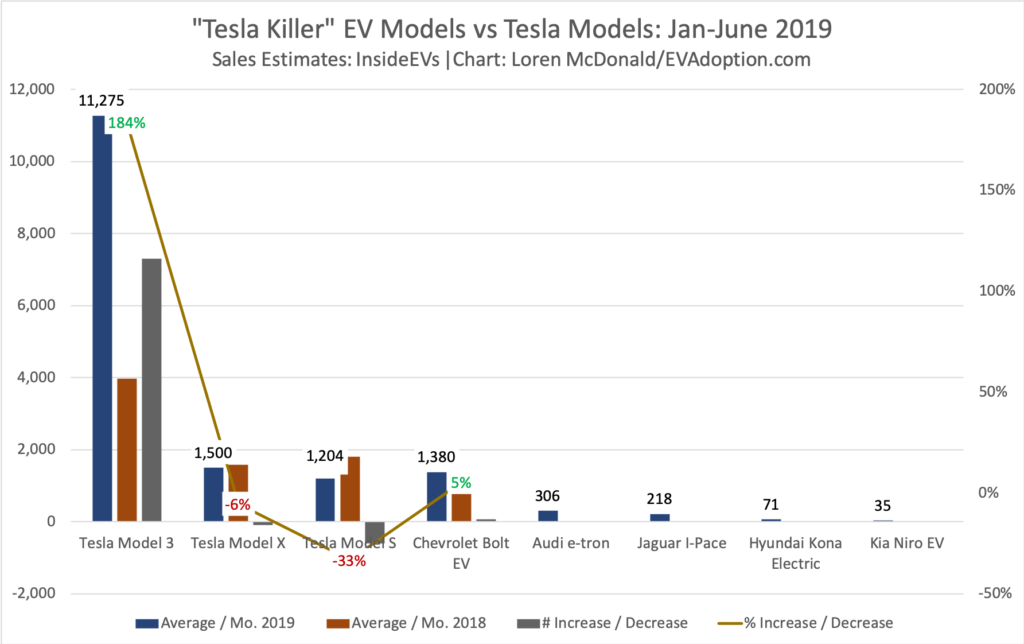

The EV models available in the US and that have received the “Tesla Killer” badge to date include the Chevrolet Bolt, Jaguar I-Pace, Audi e-tron, Hyundai Kona Electric, and Kia Niro EV. But except for the Bolt and I-Pace, it is realistically too early to confidently judge these models sales and impact on Tesla and other brands’ EVs.

That said, none of them certainly are deserving of a “Tesla Killer” crown and it is dubious that any of them have had any significant impact on sales of Tesla models. Clearly none are affecting Model 3 sales, which for January through June of 2019 has accounted for an estimated 45.5% of all EVs sold in the US.

For the Model X, for which sales are basically flat YOY, it is pure conjecture but the Audi e-tron and Jaguar I-Pace may be grabbing a combined maximum of a few hundred sales per month that would have gone to the large Tesla SUV/CUV. While the Tesla Model X has these two luxury SUV/CUVs beat in range, technology, access to fast chargers, and performance – a certain segment of buyers may place stability, brand familiarity/loyalty, customer service, and quality over the attributes where Tesla excels.

Negative sales impact on the Model S sedan from any of these models is likely minimal. Rather the YOY decline of 33% is probably almost entirely from consumers opting instead for the smaller, but lower-priced sister sedan, the Model 3.

The Hyundai Kona Electric and Kia Niro EV are both averaging sales of less than 100 units per month in the US. Granted, the Kona has only been available for 5 months and the Niro for 3 months, but the much more expensive Audi e-tron is averaging 306 units per month after only 3 months and nearly 800 units for May and June.

How can the Audi e-tron, which basically costs twice as much as the Kona and Niro, be selling at about 7 times the number of units? Again, it is really too early to draw significant conclusions but assuming the current trends continue for awhile, the most obvious reasons include:

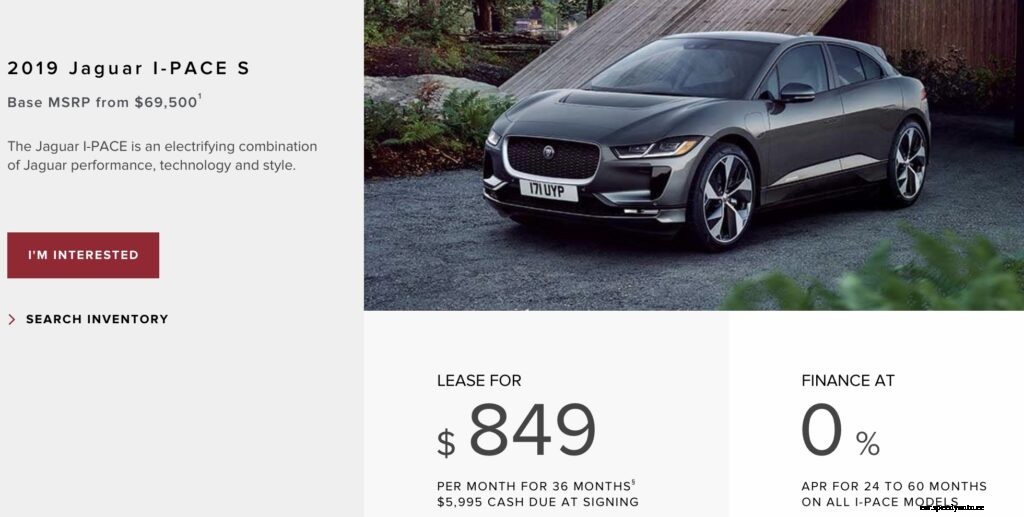

Jaguar launched its fully electric I-Pace in October of 2018 and in 2019 through June, the award-winning BEV has averaged 218 sales per month in the US. The more expensive Audi e-tron, which also has a lower EPA range of only 204 miles versus the 234 of the I-Pace, has averaged sales of nearly 800 in May and June.

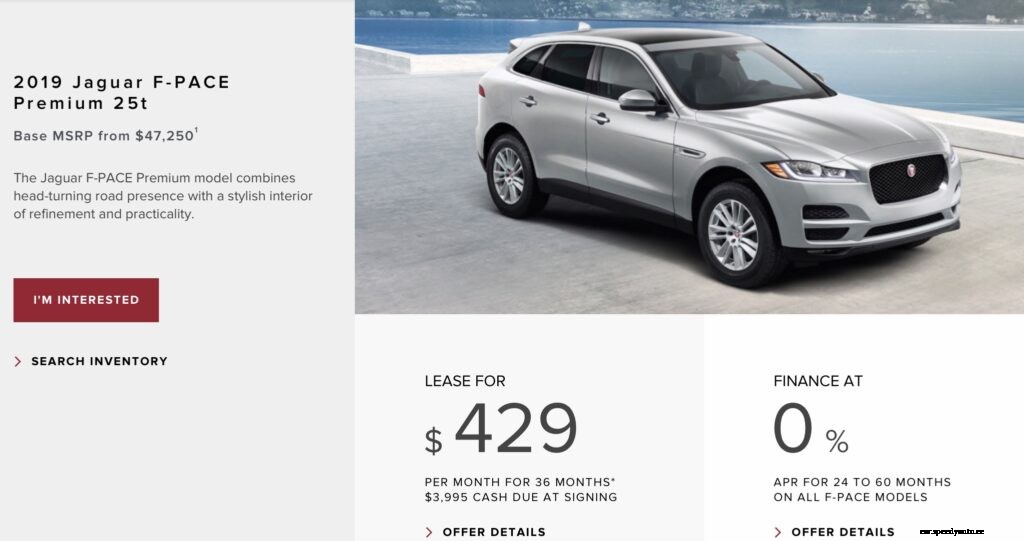

Why is the I-Pace selling so many fewer units than the Tesla Model X and at least so far, the Audi e-tron? While it is unclear if sales of the e-tron will continue at their current level or even increase, but it has already sold more units in 3 months than the I-Pace has in 9 months.

Four possible reasons come to mind:

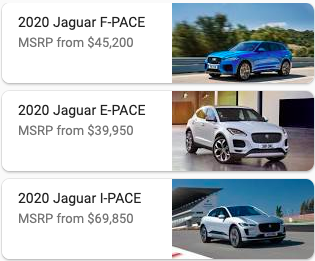

New electric vehicles available in the US in 2020 from EVAdoption.com

New electric vehicles available in the US in 2020 from EVAdoption.com

There don’t seem to be any “Tesla Killer” models on the near-term horizon, but the following future EVs (see SlideShare above) could provide some decent competition for specific Tesla models, but also might just expand the size of the EV market:

The reality is Tesla is its own biggest competitor. The future Model Y is likely to crush sales of the Model 3. But since there likely won’t be any model from other OEMs with similar range, performance and access to charging – the Model Y should do just fine.

Tesla killers may or may not ever arrive, but the better question is: When will electric models provide serious competition to Tesla?