April 2020 was a watershed moment for electric vehicles (EVs) as company cars. The UK government slashed electric company car tax, instantly making EVs much more attractive for businesses and employees. Here we take a look at what company car tax is, what’s changed, and how it compares between different types of cars.

Getting a company car is a real perk for employees. It’s often pretty exciting too. That can be tempered when you get lumped with a company car tax bill, however.

Tax is due as soon as a company car is used privately, which includes commuting to work. This is because it becomes known as a benefit in kind (BIK), with the good folk at HMRC deciding how much is owed based on several different things.

The level of company car tax you pay depends on the value of the vehicle and your earnings. It’s also affected by things like whether you have the vehicle full-time and if you pay anything towards the cost of purchase. The amount of company car tax due is also based on what type of fuel the vehicle uses and its CO2 emissions.

Put simply, if you’re on a big wage and you drive an expensive car with high emissions, you’re going to pay the most in company car tax. You can use the government’s calculator tool to work out exactly how much you owe. The amount of tax due can be very high, easily running into thousands of pounds per year – unless you have an electric car, that is.

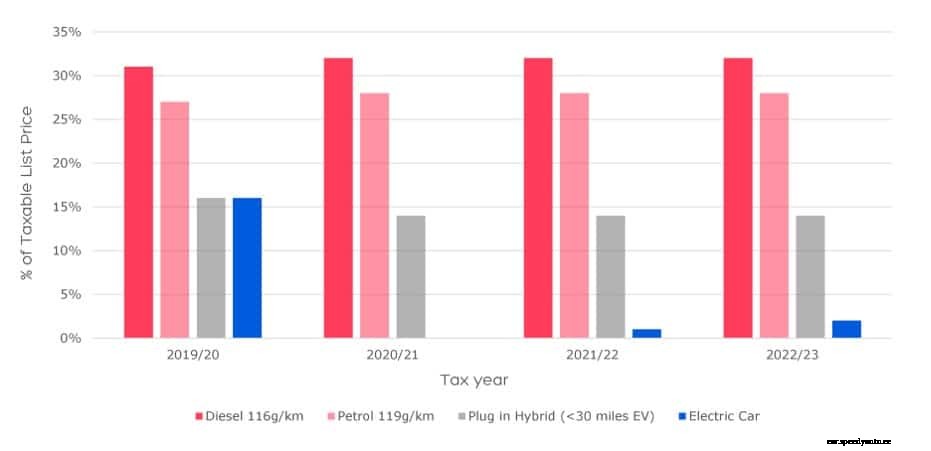

Last year, the company car tax on electric cars was eliminated (0%) for the 2020/21 financial year. That’s right; there was zero, zilch, zip all to pay. The government decided to cut the rate from 16% to 0%. Given company car tax is often hundreds of pounds a month, or even more, this means there are huge savings when you go electric.

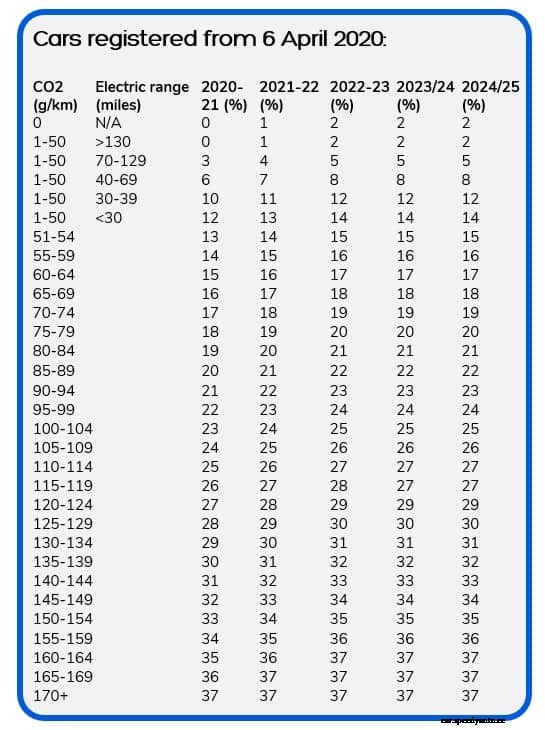

This year 2021/22, the electric vehicle company car tax rate has risen to 1% of an EV’s taxable list price. This is also known as the P11D value. The following year this rises to just 2%, keeping the level far below petrol and diesel vehicles, as well as plug-in hybrids. These other vehicles come within a new set of bands rising to a maximum of 37%, depending on emissions. Some diesel vehicles also attract an extra 4% supplement.

The new Volkswagen ID.3 Pro Performance has a P11D value from £32,935. This means the BIK in 2021/22 will be just £329 for the year. If your income is taxed at 20%, company car tax is only £66 for the year or £5 per month. At 40% this rises to £132 per annum or £11 per month, and £148 a year or £12 per month at 45 %.

Volkswagen ID.3 Pro Performance Benefit in Kind (BIK) Company car tax per month @ 20% Company car tax per month @ 40% Company car tax per month @ 45% 2020/21 £0 £0 £0 £0 2021/22 £329 £5 £11 £12 2022/23 £659 £11 £22 £25To help visualise these huge savings, we compare this to a diesel Volkswagen Golf with a P11D value of around £26,315. The BIK (Benefit In Kind) in 2021/22 would be £7,368. If your income is taxed at 20%, company car tax is only £1,474 for the year or £122.80 per month. At 40% this rises to £2,947 per annum or £245.61 per month, and £3,315.69 a year or £276.31 per month at 45 %.

Volkswagen Golf 2.0 TDI Style Benefit in Kind (BIK) Company car tax per month @ 20% Company car tax per month @ 40% Company car tax per month @ 45% 2021/22 £7,368 £122.80 £245.61 £276.31 2022/23 £7,631 £127.19 £254.38 £286.18As you can see, EVs offer enormous savings on company car tax compared to petrol and diesel models. Even after the slight rise in 2022/23, you’re looking at a saving of between £1,700 and £4,500 every year as per the example above.

As well as the environmental and reputational benefits enjoyed by both businesses and employees from running EVs, there are plenty of advantages when it comes to costs too. These include:

Electric cars aren’t just good as company cars – they’re great! Whether you’re more concerned about reducing your carbon footprint or cutting costs, the UK’s ever-expanding charging network means it’s easy to keep your battery topped up even if you cover a lot of miles each day.

From the best green company cars to the essential steps of how to lease an EV, we’re here to help and guide you on our collective journey towards a cleaner, greener future. Give us a call today to discuss your company car leasing options – our friendly team will be more than happy to answer your questions.

Sources:

https://www.gov.uk/tax-company-benefits/tax-on-company-cars

https://ev-database.uk/car/1306/Volkswagen-ID3-Pro-Performance