Up until this morning, there was still strong hope that Congress would not eliminate the Federal electric vehicle tax credit, but a late amendment puts the credit in significant doubt. Or did it?

When I woke up this morning I found the text of the Senate bill H.R.1 – Tax Cuts and Jobs Act that was passed last night and skimmed through it looking for anything about the Federal electric vehicle tax credit. I didn’t find anything and so was encouraged that in reconciliation between the Senate and House tax plans, the EV tax credit might remain intact. As a reminder, the House’s version of the tax bill eliminated the tax credit, whereas the Senate version kept the tax credit intact.

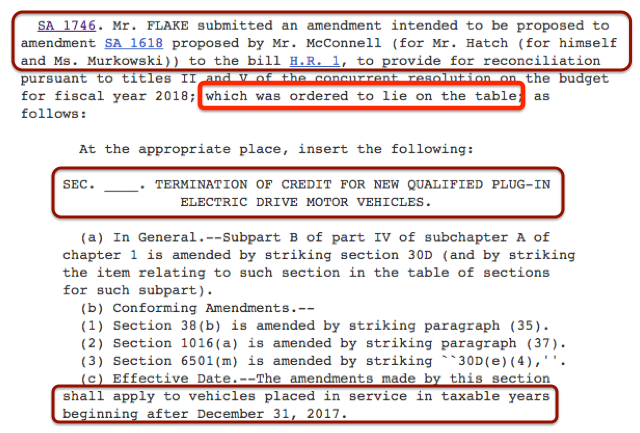

Then I came across an article over on the Electrek site reporting that during the revision process to the Senate bill, an amendment was added by Senator Flake that would terminate the credit. (See amendment screenshot below)

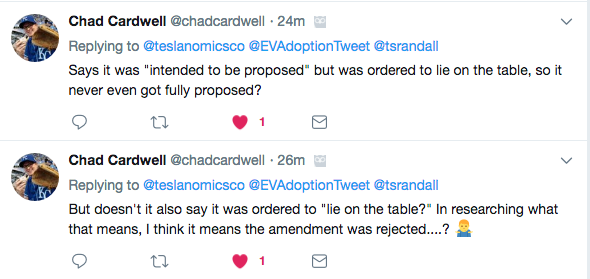

Hmm. OK, so why wasn’t this amendment in the final version of the Senate bill? And then in a Twitter exchange with a @ChardCardwell he pointed out that he thought that “lie on the table” means the Flake amendment was rejected.

So in doing my own research, it appears that “lie on the table” means that the amendment was postponed, but could be considered again in the future.

And then this document, “The Amending Process in the Senate,” was also relayed to me where I found this: “… and then moving to lay it on the table. If the Senate agrees to this non-debatable motion, the amendment is considered to be rejected or tabled.”

Confused yet? (Note: Clearly an expert on Congressional legislation is needed at this point, but we’ll forge ahead based on what we understand at this point.)

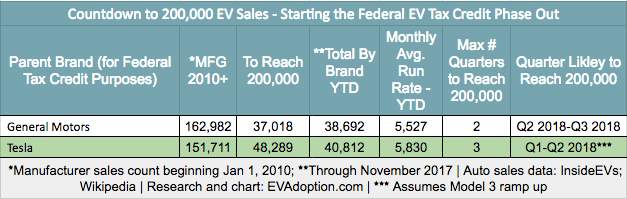

Don’t miss out on new content, statistics and analysis on electric vehiclesThings now appear more confusing than ever, but if the Flake amendment was not included in the final version of the Senate bill, then there remains some hope the credit could survive in the reconciliation process. Regardless, the two versions of the tax bills now will go to committee for reconciliation where once revised and a single bill is agreed upon, the legislation must be voted on again.

A big concern, however, is that in the context of all of the other elements of the tax bills – the EV tax credit is just not that important to members of Congress. As such, during the reconciliation process, committee Senators might concede to dropping the credit in return for House members conceding one of their proposals that different from the Senate version.

In short, however, we appear to be no closer to an answer on the status of the tax credit and it likely remains a 50-50 chance that it will survive.

Preparing for Elimination of the Tax Credit

Unlike many electric vehicle advocates, I don’t believe that the loss of the tax credit will be devastating to sales of EVs in the US. As I wrote in ‘Edmunds: “Elimination of federal tax credits likely to kill U.S. EV market” (wrong)’, comparing what happened when the state of Georgia eliminated their state credit is a mistake. The loss of the Georgia credit was devastating to sales of the Nissan LEAF because it became incredibly cheap to purchase. Some LEAF owners in Georgia referred to it as “almost being free” when the Federal and state credits and other benefits were added together. But the decline in sales of other EVs such as the Tesla Model S and BMW i3, was minimal.

The loss of the Federal EV tax credit would have a negligible negative impact on EV sales the next few years, much less than many “the sky will fall” observers predict. I’ll dive more deeply into the effects of the loss of the credit in a future article, but here a few high-level points:

Areas where I expect very little impact from a loss of the tax credit, include:

Whether the Federal EV tax credit is eliminated or remains intact, sales of EVs this month are likely going to be a December to remember.