When shopping for a car, it’s easy to get caught up in wanting to buy a brand new one and finance it. Although doing so can yield a lot of money spent through interest payments over the years in addition to having a pesky monthly payment. On the other hand, buying a used car can save you a lot of money upfront and during the time of ownership, but how do you find one that’s within a reasonable budget? In that case, you can use the “$1,500 rule.”

While you might think that the “$1,500 rule” means that you’ll need to pull up your local Craigslist ads and peruse the sea of rusted-out beaters in search of a car that costs $1,500 – it doesn’t. Instead, that number is the result of a simple equation made to calculate the cost of ownership of a car per year. The main purpose of the equation is to find a car that is priced economically so it doesn’t cost an arm and a leg, or a hefty monthly payment, to drive it around for five years (or more).

The $1,500 rule, which was invented by a blogger that goes by the name of “Mystery Money Man,” breaks down like this:

According to the Mystery Money Man, the whole point of this rule is that it works with a variety of income levels. By using this rule, you don’t need to make a lot of money to afford a car. After all, cars are depreciating assets, so most of the time, there’s no sense in buying a brand new car that will eventually depreciate in value.

Additionally, the $1,500 rule encourages car buyers to spend less on buying a vehicle for themselves or their families. Let’s face it, unless you really need all of the tech that the new car has, you can easily find a slightly used version of the same car that will serve the same purpose.

Lastly, if you want to buy a used car in a higher price range, but want to stick with the rule, then you’ll just have to keep it for longer. The more you spend, the longer you’ll have to keep it to stay within the $1,500 per year limit.

The Mystery Money Man goes on to say that this rule isn’t solely reserved for used cars as it can work for new ones as well. Again, you’ll just have to keep the car for a longer period of time to make it worth it.

To sum it up, you can use the $1,500 rule on your next car purchase in order to keep yourself in check as to how much to spend on a car. The goal isn’t to stretch out the time of ownership of the car in order to fit the rule, rather, the goal is to use the rule in order to find a car that really fits your budget.

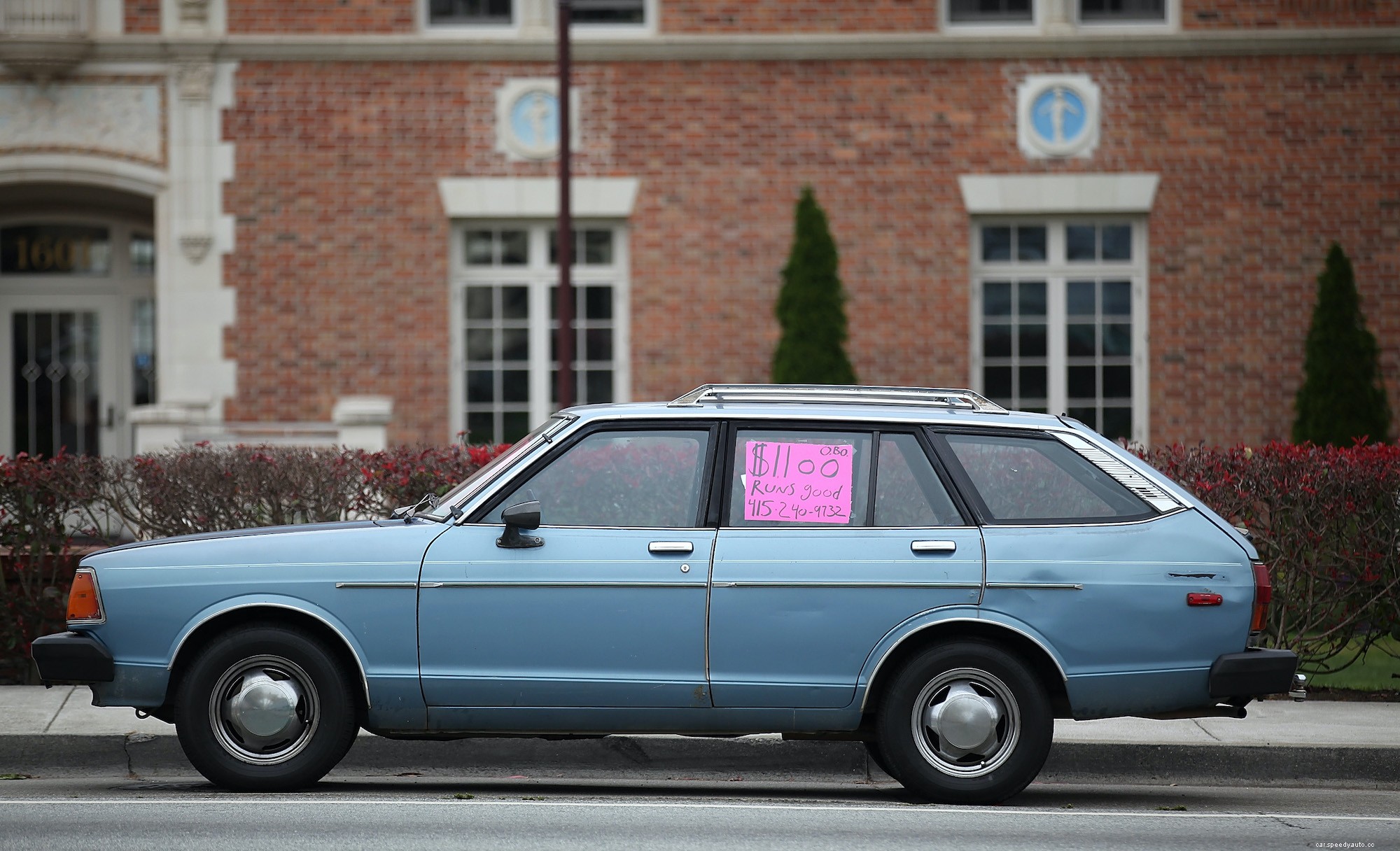

What’s even better is that if you use this rule the next time you buy a car, chances are that those older used cars will start to make more sense when it comes to sticking to your budget. Fortunately, it won’t have to be one of those $1,500 beaters on Craigslist.