For most electric car enthusiasts, PHEVs (Plug-in Hybrid Electric Vehicles) always were only a stopgap until BEVs (Battery Electric Vehicles) finally got the range they needed. They were important for early adopters, but now, BEVs with more energy dense batteries are making them obsolete.

Let’s look at the 20 most sold electric car models in the world. The data is provided by José Pontes from EV-Sales.

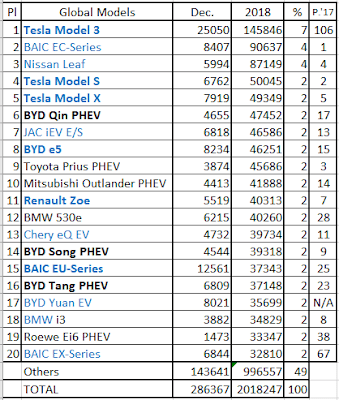

In 2018, the World top 20 of electric car sales had 7 PHEV models and 13 BEV models.

Top 20 electric car sales in 2018 by EV-Sales

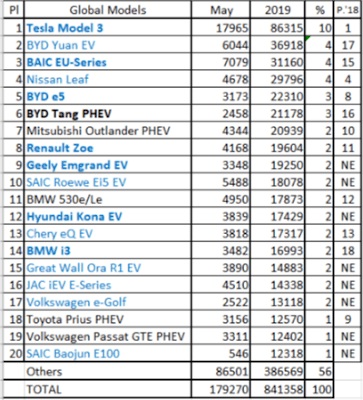

Now, looking at the latest figures (May 2019 YTD) we have 5 PHEV models and 15 BEV models in the top 20.

Top 20 electric car sales in May 2019 (YTD) by EV-Sales

Not long ago the Chinese auto giant BYD was the biggest supporter of PHEV technology, but since the introduction of high energy dense batteries, the automaker changed its focus to BEVs. This clearly shows the future ahead.

BEVs started to gain a clear advantage over PHEVs with the introduction of NCM 622 and NCM 523 battery cells back in 2017. Nonetheless, things will get even better for BEVs with the adoption of more energy dense battery cells.

This year marks the arrival of the long-awaited NCM 811 battery cells to electric cars. The NIO ES6 already had its first deliveries to customers and the GAC Aion S will soon follow.

While South Korean battery cell makers (LG Chem and SK Innovation) were the first to announce the arrival of NCM 811 batteries, it was a Chinese company that won the race.

CATL’s strategy of hiring South Korean battery experts paid off, now the Chinese company is the technological leader and South Korean battery cell makers are facing serious problems to keep up.

We’ll soon see CATL batteries in European electric cars, since the Chinese company is a supplier for some European automakers such as PSA and Volkswagen. In an internal document, CATL reveled that it will supply batteries to the VW ID.3, however I don’t know if it’ll be the sole supplier.

Anyway, what does high energy dense batteries mean to electric cars?

Mainly, two things. More range and lower costs. For example, a 60 kWh battery that thanks to a new technology can be made by using less raw materials not only makes possible a lighter battery, but also a lower cost per kWh.

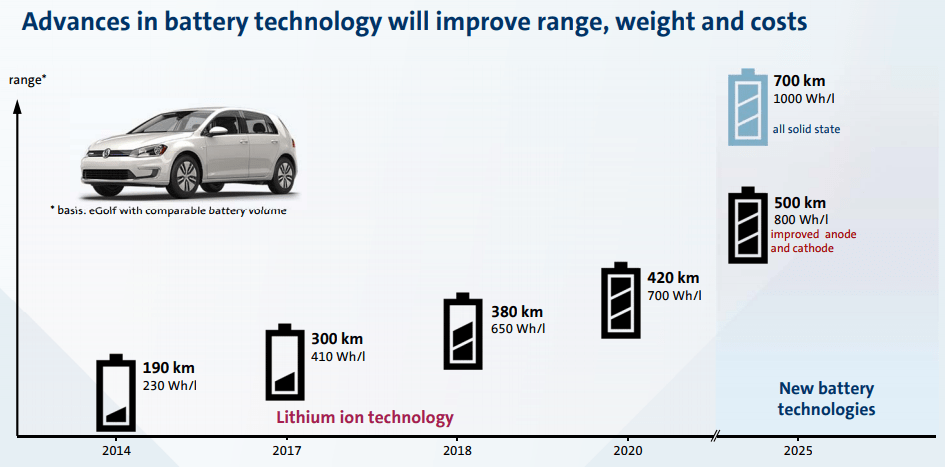

Let’s see what Volkswagen expects to achieve with more advanced battery cells already in 2020.

Advances in battery technology will improve range, weight and costs by Volkswagen

A 420 km WLTP range for the Volkswagen ID.3 – achieved with a 58 kWh battery – would be enough to make electric cars mainstream if the price is right.

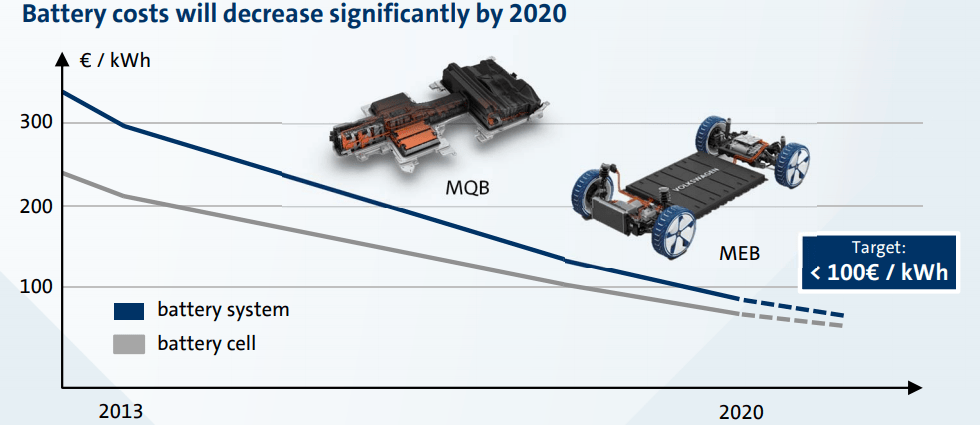

Battery costs roadmap by Volkswagen

We already know that the Volkswagen ID.3 will have 45, 58 and 77 kWh batteries. Let’s see how much they’ll cost to VW. We’ll consider 90 euros per kWh, since that’s the figure revealed in a VW internal document.

As you can see NCM 811 batteries make possible affordable BEVs with decent range, rendering obsolete the complex PHEVs. I think that even Toyota realized it by now, if not, all its hybrids would already have a plug. When the automaker that already sells most of the hybrids doesn’t even bother to make them plug-in, is a clear sign that the technology is seen as transitory and not worth the effort.

However, even if the current battery technology is enough to make affordable electric cars with decent range, there is a big obstacle to electric car adoption. The “dinosaurs” in charge of legacy automakers still lie about battery costs – even when their own internal documents contradict it. This way they can use it as an excuse to convince politicians and public opinion that the electric car technology isn’t ready yet for mass adoption. That’s how automakers successfully delay the adoption of stricter emission regulations that would finally lead to electric cars taking over.

Curiously, it’s the reluctance of making electric cars that’ll bankrupt some legacy automakers, they are fighting regulations that would actually push them forward and prepare them for a not too distant future.